The Quiet Squeeze on 8‑Year‑Plus Whiskey

Why mature liquid remains scarce even as younger barrels soften — and what it means for buyers For the last two years, the dominant narrative in bulk...

4 min read

Matt Breese

:

Aug 7, 2025 10:27:26 AM

Matt Breese

:

Aug 7, 2025 10:27:26 AM

In a category where barrels tend to steal the spotlight, Venture First operates where the real structure of the whiskey industry is often forged: behind the scenes—in the capital, data, and discipline that underpin long-term growth. This isn’t just a finance firm operating in whiskey. Venture First is helping professionalize the space.

Venture First, based in Louisville, is best known for providing fractional CFO, FP&A, and valuation services for growth-stage companies. But what began as regional exposure to distilling clients evolved into a focused and well-structured entry into whiskey lending. Their credit fund, Whiskey Capital, emerged as a direct response to the gap traditional lenders left behind.

We sat down with Jack Hellige, VP of Funds & Transactions, to learn more about their business.

In what is a very capital-intensive industry by nature, they saw that brands were hitting a wall when it came to financing—especially around barrels. Banks didn’t understand the market. Equity was an expensive solution for working capital needs. So Venture First took its operational experience and financial rigor and built something that did.

Venture First’s move into whiskey wasn’t a pivot—it was a response to real industry needs.

Unlike barrel funds or SPVs chasing appreciation curves, Venture First has always approached this as a capital solutions business. Roughly 80–85% of their activity is focused on direct lending, mostly on younger or new fill barrels. The rest? Selective barrel exposure at investor request purchased on balance sheet for future use by their clients. Their investment strategy is rooted in conservative underwriting and long-term alignment.

This focus has helped them navigate and minimize the impact of the volatility now felt across much of the category. Where others rode the boom, Venture First built a model designed to endure the cycles.

That mindset took root around 2017-2018, when they began working with distilleries and emerging brands in the region. They assisted various brands in capital raise efforts and also supported names like JW Rutledge and Southern Distilling over this timeframe. As they tried to secure financing from banksfrom the operator side of the table, they quickly realized a major disconnect:

“Traditional banks didn’t understand the whiskey barrel market. It was underbanked and niche.”

So they built something new.

To fill the lending gap, Venture First created Whiskey Capital, a private credit fund focused on working directly with producers—not intermediaries, barrel funds, or speculators.

“We’ve always been lenders first. About 80–85% of what we do is credit. A small portion is reserved for barrels, only because that’s what some investors asked for.”

Their model prioritizes younger or new fill barrels and avoids speculative plays on barrel pricing. It’s a strategy built around consistency, responsible underwriting, and long-term viability.

Their institutional credibility didn’t happen by accident. Partnering with Steve Campbell, a former Lazard managing director, they built a fully regulated GP/LP, developed a 100-page PPM, and created risk frameworks that checked all the boxes for institutional investors.

“You can’t walk in looking like you’re shooting from the hip—you’ve got to be buttoned up, regulated, and speak their language.”

The result? Targeted double-digit cash yields with downside protection and unique exposure to a historically under-accessed asset class.

Whiskey Capital is just one side of the Venture First equation. The firm continues to provide full-service financial support across the industry—from serving as fractional CFO to offering FDIC-reviewed barrel valuations for banks and funds that stand up to FDIC and big four audit review.

For early-stage brands, that means access to a full stack finance team (CFO, analyst, and accountant) at the cost of a single full-time hire. For institutions, it means trusted, third-party data and industry insights with no spin.

The firm began lending in whiskey in 2018, well before the recent market froth. And their posture hasn’t changed since.

“We didn’t jump in when things were hot. Our first loans were in early 2018. This is a cyclical industry, and we plan to be here through all of it.”

They work directly with brands and distillers—not intermediaries—and maintain flexibility other lenders can’t. They also own inventory, which allows them to step in creatively when deals need structure other firms can’t offer.

Venture First has built one of the most nuanced, independent data sets in the business, grounded in its proprietary barrel transaction records and further enriched by insights from traditional sources like IWSR, KDA, and DISCUS. And because they’re not trying to broker barrels or inflate valuations, that data speaks with unusual clarity.

“We place the most weight on what’s actually occurred. This isn’t modeled market fluff—we track real transactions, inventory, and capacity.”

For a deeper look at how this disciplined, data-first approach shapes their lending and investment philosophy, explore the full story in "What Is My Barrel Worth?"—a behind-the-scenes feature on how Venture First is helping build the financial infrastructure of whiskey.

Venture First isn’t looking to monopolize whiskey finance. In fact, their goal is to help grow liquidity across the ecosystem—whether that’s connecting with banks, supporting other funds, or bringing transparency to the broader market. Their February summit, an invitation only event which brought together 30+ brands for a closed-door state-of-the-market discussion, is just one example.

The partnership with Brindiamo reflects Venture First’s collaborative philosophy.

“They're one of the most trusted resources. Whether it's mash bill guidance during due diligence, valuation checks, or buyer/seller referrals, they've been essential to how we navigate this space.”

As the whiskey industry recalibrates, Venture First’s model offers something rare: structure, staying power, and transparency. They’re not here for the cycle—they’re here for the long game.

And if whiskey is going to keep maturing as an asset class, this is the kind of financial partner it will need.

A huge thanks to Jack Hellige for sitting down with Brindiamo for this unique piece! Learn more about Venture First and Whiskey Capital by visiting them at https://venturefirst.com/ and https://whiskeycapitalfinance.com/.

Why mature liquid remains scarce even as younger barrels soften — and what it means for buyers For the last two years, the dominant narrative in bulk...

As we reflect on 2025, we wanted to take a moment to look back with you. This past year, our team published across more mastheads than ever before —...

Welcome back to the Brindiamo Barrel Spotlight, our weekly email series highlighting the barrels, distilleries, and market dynamics shaping today’s...

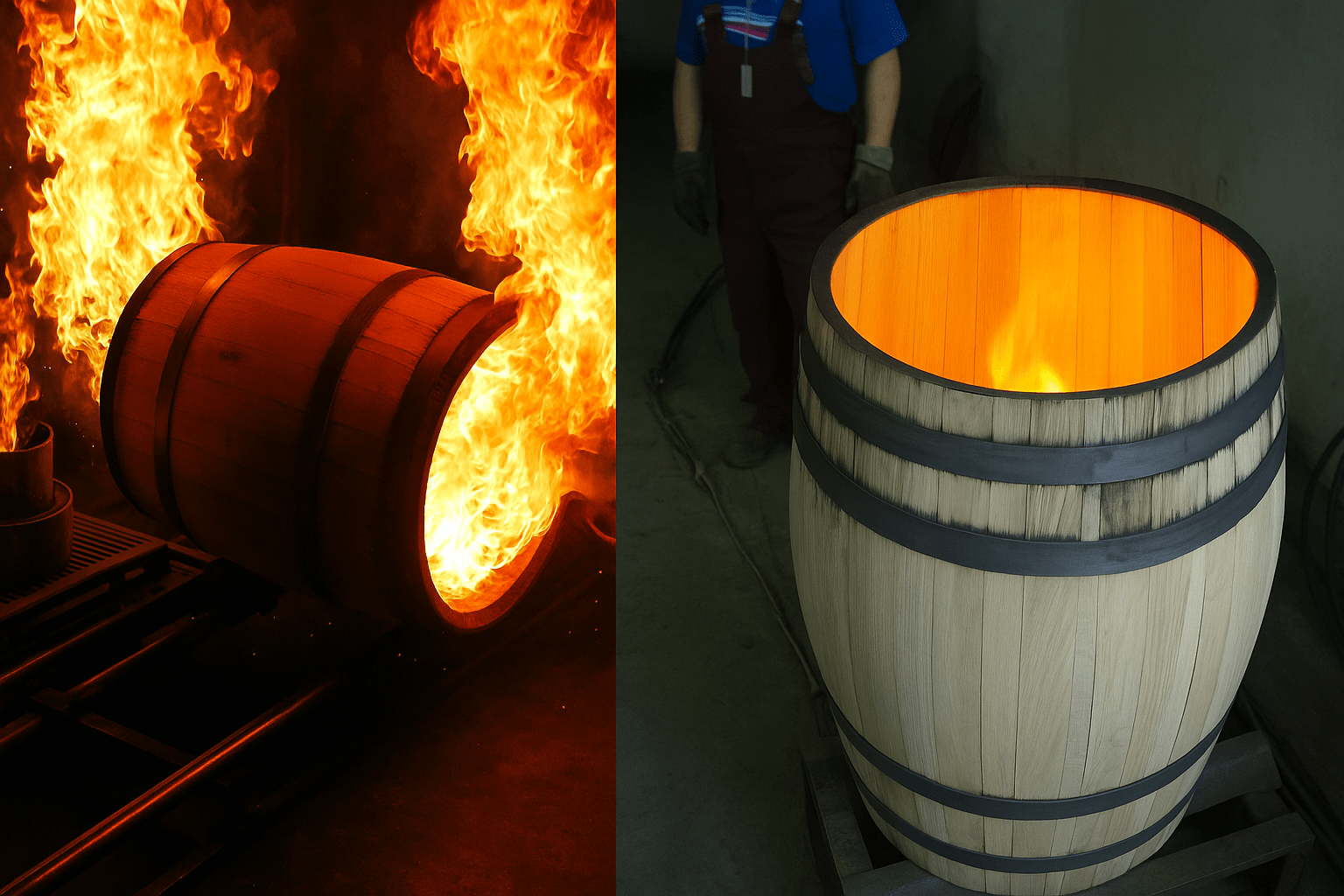

When we think about how whiskey gets its flavor, most people immediately point to the type of oak or the age of the cask. But an unsung hero of...

Whiskey is one of the world’s most revered spirits, but not all whiskey is created equal. Two key categories—new fill whiskey and aged whiskey—play...

.png)

Did you know that whiskey sales account for millions of dollars in the alcohol industry annually? To run a successful alcohol business, it's crucial...

Join the conversation

Leave a comment below.