The Quiet Squeeze on 8‑Year‑Plus Whiskey

Why mature liquid remains scarce even as younger barrels soften — and what it means for buyers For the last two years, the dominant narrative in bulk...

4 min read

Jack Sullivan : Oct 24, 2025 2:31:53 PM

The market for bourbon barrels is bifurcated. Over the course of the last 24 months, the conversation has shifted from how to find whiskey to how to find the right whiskey at the right price. That shift, while uncomfortable for some, is healthy for the long-term balance of the industry, and a tailwind for NDPs to compete for market share.

For investors, this correctionary period offers what the last decade could not – truly opportunistic entry points. Capital, when deployed with patience and well executed liquid strategy, is being rewarded.

The last ten years saw the whiskey industry undergo its largest expansionary period to date. Producers built capacity at record speed, investors bought barrels with confidence, young whiskey traded for a premium, and new fill was the ticket simply because it meant you had product. The accepted logic was simple: you never regret owning good whiskey. That belief wasn’t wrong, but it was incomplete.

Between 2018 and 2023, many barrel owners, from established brands to private investors, operated under a hardline scarcity assumption. The collective memory of shortage pushed the market to fill aggressively and build more – fast. Rapid expansion, growth, and quickly deployed capital shifted the focus from the fundamentals of what makes a barrel valuable – the bottle – to B2B arbitrage. During this period, the market believed the hardest challenge would be finding whiskey. That belief, combined with low interest rates, aggressive lending practices, and new investor enthusiasm was never going to emerge on the other end in equilibrium.

Today, the fundamentals cannot be ignored. Oversupply and liquidity headwinds are center of industry conversations for players of all sizes.

The present market’s oversupply has been well-documented. Analysts have been clear about the imbalance. Commercial Spirits Intelligence places the inventory-to-consumption ratio around 10:1, a figure that will take time to correct.

Warehouses are full and distilleries are managing their production outflows quietly. Production numbers for 2025 are on pace to be their lowest since 2017 while demand remains well above pre-COVID levels. The correction is a self-rationalization, and a deliberate one at that.

If oversupply explains how we got here, liquidity and bottle demand explain how we’ll find equilibrium. Incentives have shifted. Many barrel owners who overextended during the boom are now seeking exits. Some are moving hundreds of barrels, others thousands, often at prices that clearly demonstrate liquidity is paramount to return.

Quality barrels, especially those from proven distilleries, continue to clear quickly when priced right, while others sit with no clear path to bottle. The market is saying clearly that not all whiskey is equal. Pedigree, provenance, and storage conditions matter more now than at any time in the past decade.

In this market, cash is king. Investors and brands alike with available capital can act faster than competitors, acquire premium whiskey at favorable pricing, and position themselves as leaders in bulk sourcing for the aged market.

Brands continue to source. They have simply become more selective, demonstrating clear preferences for certain distilleries, mash bills, and higher-ages.

Across the industry, the approach is consistent. The best barrels are being bought with purpose, not urgency. New brands continue to launch, but with tighter sourcing parameters. They are choosing mash bills that align with long-term identity, selecting barrels with tighter flavor profiles, consistency, and preferably, long-tailed access that allows cash flow flexibility.

Established producers are behaving in similar ways. Some are filling gaps in their portfolio. Others are supplementing in-house production with sourced liquid to blend and lower cost inputs. The middle of the market, the range where MSRPs overlap and price sensitivity peaks, remains the most competitive space. That is also where smart sourcing delivers the greatest brand leverage.

Much of the conversation still revolves around barrel pricing. But barrels are only one input in a larger model. Consumers define value, not traders. Barrel investors that understand this model, are best positioned to invest strategically in a way that elevates whiskey as a category.

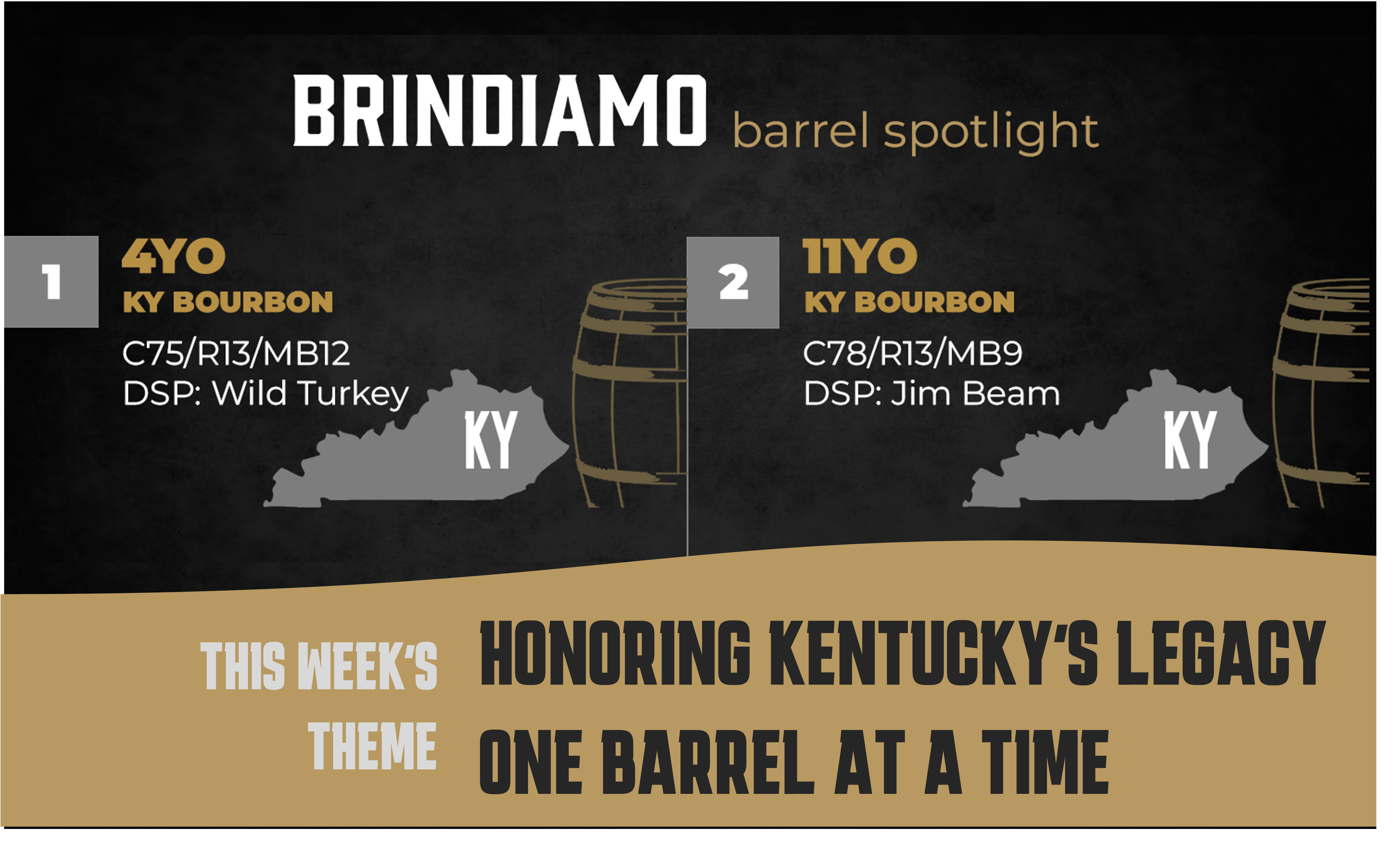

Recent Brindiamo Barrel Spotlights have illustrated this well. Mature lots from Kentucky producers, chosen for both quality and story, have moved quickly. Those barrels didn’t just sell. They helped brands accelerate release timelines and strengthen identity in a crowded shelf space.

Today’s whiskey buyer is being rewarded with higher ages and better-developed liquid across every tier. Oversupply, for all its challenges, has raised the average quality available at retail. The gap between mid-shelf and premium is narrowing.

For brands, sourcing strategically asks not what is the cost of the barrel, but how much can a bottle of this whiskey sell for?

Volatility and turbulence create opportunity. The bourbon market today is no exception. The universal year-over-year appreciation model that defined the last cycle has disappeared. What remains is differentiation.

The right whiskey continues to appreciate based on merit and bottle-backed demand. Entry points on both young and mature stock are more attractive than they have been in several years.

Portfolio structure matters more than ever. The most successful investors are not betting on single vintages, but laddering across ages, diversifying portfolios, and working on natural exit outlets immediately. This approach turns barrels from a static asset into a dynamic one, with flexibility built in across time horizons.

Brindiamo’s vantage point provides clarity across that curve. As both a buyer and facilitator in the market, the firm sees daily where pricing inflects and where volume moves. That data helps separate inventory that is merely cheap from inventory that is genuinely undervalued. These deals are not occurring every day, but when they do, they’re clear.

The current correction has made one truth clear. Not every barrel has a home. Price alone does not guarantee liquidity.

For investors, success is no longer defined by acquisition. Knowing where and how barrels can be placed, bottled, or blended determines returns.

Export markets remain a promising but complicated outlet. Price expectations, especially against Blended Scotch – the barometer for international bulk whiskey pricing – remain a hurdle. Domestic demand still drives the majority of value consumption, while export markets provide windows to move significant volume – a vital outlet to working through the oversupply of young barrels.

The bourbon market has always balanced two forces: capital and character. One builds capacity. The other builds legacy. When they move together, both strengthen.

For investors that understand the landscape and have the partners to help them execute in it, this period is one of immense opportunity. While turbulence is jarring, it also presents windows to generate value.

Investors who read those fundamentals accurately, deploy capital where quality meets opportunity, and manage timing with discipline will be well-positioned. Bourbon remains what it has always been: an asset that rewards patience and precision in equal measure.

Brindiamo stewards leading family offices, private funds, and institutional investors through the global whiskey landscape. Our team provides visibility into supply, pricing, and brand demand, helping capital find its best expression in this market. Feel free to fill out your information on our Contact Us page or email him directly at jack.sullivan@brindiamogroup.com.

Why mature liquid remains scarce even as younger barrels soften — and what it means for buyers For the last two years, the dominant narrative in bulk...

As we reflect on 2025, we wanted to take a moment to look back with you. This past year, our team published across more mastheads than ever before —...

Welcome back to the Brindiamo Barrel Spotlight, our weekly email series highlighting the barrels, distilleries, and market dynamics shaping today’s...

Getting started with investing can be intimidating for those who are new to it. With so much to think about, it's understandable to feel overwhelmed....

Welcome to the Brindiamo Barrel Spotlight, our weekly series celebrating the barrels, distilleries, and market dynamics shaping today’s whiskey...

Welcome back to the Brindiamo Barrel Spotlight, our weekly email series highlighting the barrels, distilleries, and market dynamics shaping today’s...

Join the conversation

Leave a comment below.